The 2025 Arizona Charitable Tax Credit maximum is $495 for individuals and $987 for couples filing jointly!

You can provide free healthcare for those in need at no cost to you! Through the Arizona Charitable Tax Credit you can receive a credit on your Arizona tax liability up to $495 individually or $987 for couples filing jointly.

Sage Foundation for Health is a Qualified Charitable Organization (QCO), eligible for the Arizona Charitable Tax Credit. Any Arizona taxpayer is eligible to claim this credit and it does not conflict with other Arizona tax credits. This means that you can donate to each type of organization and claim each credit. If you itemize your federal taxes, your gift to Sage Foundation will also qualify as a federal deduction.

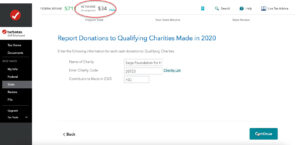

All charitable tax credit organizations have been assigned a Qualifying Charitable Organization (QCO) Code. Donors will be required to use this code when taking the tax credit on their income tax returns. Sage Foundation for Health’s QCO Code is 20723.

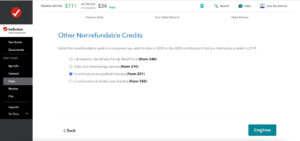

At the beginning of each calendar year, we will send you a summary of your donations from the previous year as well as AZ Form 321. When filing your State taxes, you will be asked if you made any contributions to qualified charities (see example image below). You’ll select the appropriate credit(s) and click continue. *Please note these totals do not reflect the new 2025 tax credit increase.

You’ll enter Sage Foundation for Health as the charity name and include our QCO Code: 20723. You’ll also include your total donation amount.

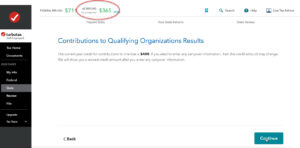

After clicking continue, you’ll see the amount of what you owe to the State decrease, or the amount of your State return increase.

*Please keep in mind this is only intended to show the process of taking the credit in TurboTax. This is not tax advice and your specific tax situation may vary. Learn more about the Arizona Charitable Tax Credit by speaking to your tax preparer or through the Arizona Department of Revenue.